Companies need effective learning programs to transfer knowledge and skills to employees, customers and partners, to retain employees and to improve speed to proficiency. But how they develop this knowledge transfer capability varies. Learning programs can be grown organically over time, developed in-house, outsourced to a learning provider or implemented using some combination of in-house and external expertise.

Every other month market intelligence firm IDC surveys Chief Learning Officer magazine’s Business Intelligence Board on a variety of topics to measure senior learning and development executives’ attitudes, issues and interests. This month’s topic is learning outsourcing, and the findings and interpretations are relevant to companies that outsource and those considering outsourcing.

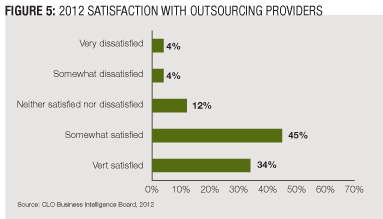

The decision to outsource often rests on the volume and quality of learning internal staff can support. Overall, enterprises that outsource learning are satisfied with outsourcing, and expect to maintain or increase spending levels for 2013. About 50 percent of enterprises use an outside provider to augment some part of their learning function. Most often, enterprises use external vendors for content development, learning delivery and learning technology management.

It’s All About Change

IDC defines learning outsourcing as the ongoing transfer of the management and execution of one or more complete learning processes to an external services provider. However, it is clear from survey results during the past several years that this is not the marketplace’s current definition. The types of learning activities purchased suggest enterprises use the term learning outsourcing synonymously with any use of external learning providers.

In the past several years, there has been a decline in the number of enterprises that outsource part of their learning functions. In 2007, 58 percent of enterprises outsourced some portion of their learning process. By 2010 only about 45 percent of CLOs reported outsourcing some portion of their learning function. In IDC’s most recent survey, the trend appears to have stabilized, with 50 percent of enterprises reporting outsourcing some portion of their learning function for the past two years (Figure 1).

While the challenging economy was a significant driver of the downward trend, it likely will be an equally large driver for the recovery. As companies begin to recover, learning’s urgency continues to rebound from its nadir during the 2008 economic crisis. Enterprises leverage external providers to deliver more learning than internal resources can provide while gaining access to better learning expertise and controlling costs. The steady use of outsourcing is expected because many of the drivers, benefits and satisfaction in learning outsourcing have remained consistent during the past several years.

Most companies only outsource select portions of their learning functions — only 4 percent outsource the entire learning function. This percentage has remained relatively constant, even while the percentage of enterprises outsourcing portions of their learning function declined and then recovered. This makes sense: Outsourcing the full learning function is not an easy decision, nor is it one that should be made quickly. Further, most organizations are satisfied with their outsourcing arrangements, which provides little incentive to radically change their use of the practice.

Companies that outsource spend a bit less than a quarter of their learning budgets on external outsourcing services (Figure 2). This is a small decrease from 2011. Eighty percent of enterprises that outsource some portion of their learning spend less than 40 percent of their learning budget on outsourcing, and 37 percent spend less than 10 percent.

For 2013, 44 percent of companies expect spending on learning outsourcing to increase (Figure 3); this parallels last year’s survey results and suggests companies that outsource are satisfied with their external learning providers. While the economy is still challenging, only 18 percent of companies indicated their learning outsourcing budgets will decrease next year — up slightly from 15 percent in 2011.

Some analysts and experts expect enterprises to outsource only non-core activities. CLOs, however, seem to be willing to outsource more strategic capabilities as well.

The activities that CLOs identify as most important include custom content design/development and learning delivery. Also important is strategy development, with program oversight and learning technology management. The importance of these activities hasn’t changed much during the past several years — suggesting overall priorities haven’t changed much, either.

Figure 4 compares the importance of learning functions with those functions most frequently outsourced, including custom content, learning delivery and LMS use. However, learning functions that are highly important but require the transfer of management responsibilities to execute — such as strategy development, program oversight and reporting and measurement — show a lower popularity for outsourcing.

Some aspects of learning outsourcing have not changed much. In the past, a majority — 74 percent — of companies chose outsourcing to gain access to better learning expertise or to deliver more learning than internal resources could provide. These reasons remain consistent with last year’s survey results.

However, other reasons to outsource have shifted significantly. As recently as 2007, speed to market was a significant rationale for using external providers. During the past several years this has declined. Even while organizations rebound from the economic crisis, they are less likely to leverage external vendors as a way to get essential learning delivered quickly.

Companies often leverage outsourcing to supplement internal resources and have learning resources available on an as-needed basis. But increasingly, organizations believe learning outsourcing is a more cost-effective method to create or deliver learning.

Pick an External Authority

The percentage of CLOs who report being satisfied — either very or somewhat satisfied — with their providers overall continues to rise. This year, 78 percent of enterprises report being satisfied with their providers, an increase from 2011 and 2010 (Figure 5).

The most important qualities CLOs consider when looking for a learning outsourcing provider are learning and subject matter expertise. These are the fundamentals to provide high-quality learning services and to effectively impart knowledge to the audience. Providers increasingly emphasize the importance of industry-specific knowledge.

It is also important that the vendor act as a business partner. CLOs understand the fluid nature of learning objectives and the flexibility that successful learning outsourcing arrangements require. Providers must be willing to adapt their methodologies to provide the most suitable services for clients as business needs change.

Companies that don’t outsource typically cite satisfaction with their internal learning operations. They may believe outsourcing is too expensive or that the subject matter is too complex for external providers. These reasons have been consistently important for the past six years of this survey. Essentially, organizations approach knowledge transfer capability differently — as an internal capability, an external capability they can hire or a mix of the two. The reasons for outsourcing — primarily capability and knowledge — are the same for those who outsource and those who don’t.

Leveraging external providers is a well-established service. There has been a small decrease in the number of enterprises that plan to outsource and the amount companies spend on outsourcing. But companies that outsource are satisfied with the results and expect to increase or maintain their levels of spending with external learning providers. Finally, enterprises often outsource activities that do not require the transfer of management control to an external provider.

As enterprises continue to emerge from the economic crisis, it will be interesting to see how the use of external providers changes — whether organizations will attempt to bank their savings on external assistance or to do more with less on their own.

Cushing Anderson is program director for learning services at IDC, a market intelligence firm. He can be reached at editor@CLOmedia.com.